ONE OF AUSTRALIA’S LEADING FINANCE & MORTGAGE BROKERS

ONE OF AUSTRALIA’S LEADING FINANCE & MORTGAGE BROKERS

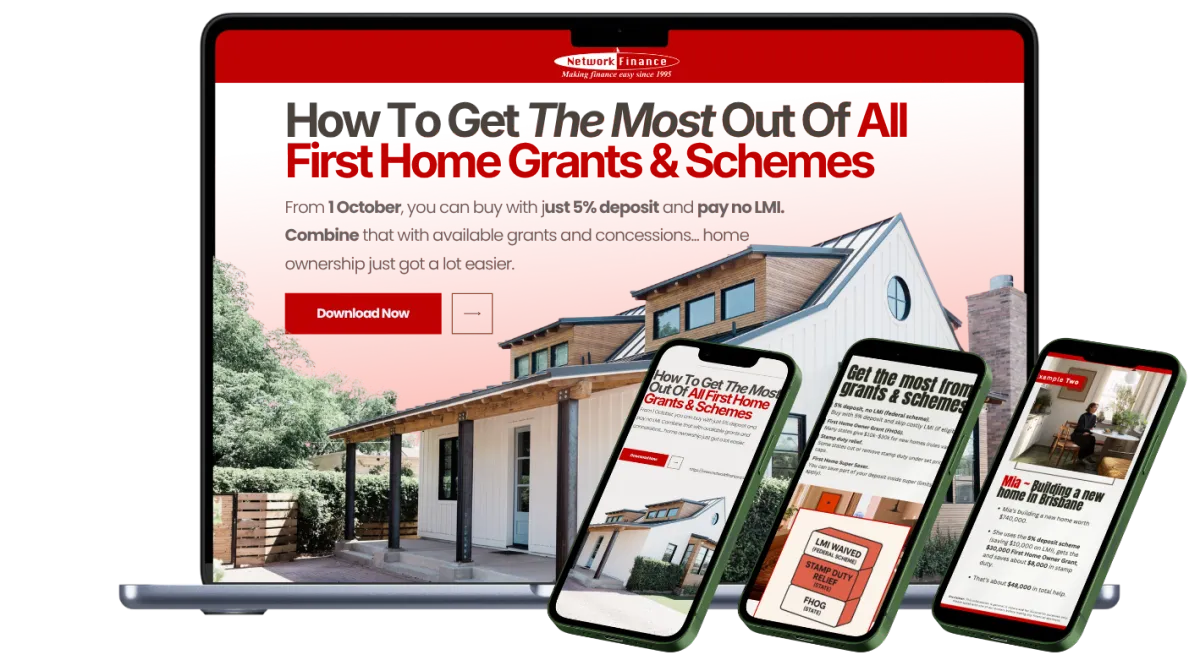

FROM 1 OCTOBER 2025 YOU CAN BUY YOUR FIRST HOME WITH ONLY A 5% DEPOSIT AND NO LMI*

Download Free First Home Buyers Guide

Everyone with a 5% deposit can now apply.

Buy a home worth up to $1.5 million.

We work for you, not the banks.

DOWNLOAD OUR FREE 5-MINUTE GUIDE

How to use first home grants and other help the right way

Examples of combining available help to save on your first home

How the 5% deposit, no-LMI scheme works and who’s eligible

A simple breakdown of schemes, grants and stamp duty relief

What other costs to plan for + a pre-approval checklist

ACCESS UP TO $55,000 IN COMBINED UPFRONT SAVINGS AS A FIRST HOME BUYER

First home buyers have more support than ever to step into the property market.

From 1 October 2025, unlimited places under the Home Guarantee Scheme mean you can buy your first home with as little as a 5% deposit, and skip costly Lenders Mortgage Insurance (LMI) altogether.

Combined with state incentives, you could unlock up to $55,000 in savings through, see this example:

Some states offer first home buyer grants on new homes, sometimes up to $30,000, depending on local rules.

Stamp Duty Concessions can save up to $24,525 on homes priced below $800,000.

The LMI Waiver, valued between $10,000 and $30,000, is available through the government-backed 5% deposit scheme.

The new rules vary slightly from state to state, but some buyers can now purchase with price caps as high as $1.5 million. Book a call with us, and we can tell you what you're eligible for.

Information is general in nature and does not constitute financial or legal advice. FHOG usually applies to new homes. Avoided LMI depends on price, deposit and lender. Eligibility criteria, property price caps, and grant amounts are subject to change and individual lender policies. Please consult our mortgage brokers or visit housingaustralia.gov.au for full details on the Home Guarantee Scheme and related incentives.

Hi, I'm Matt from Network Finance.

We help everyday Aussies get into the property market faster and easier.

Hi, I'm Matt from Network Finance.

We help everyday Aussies get into the property market faster and easier.

MORE HOMES WITHIN REACH FOR FIRST HOME BUYERS

1

Buy your first home in Australia with as little as a 5 percent deposit.

2

Avoid paying costly Lenders Mortgage Insurance, and keep more of your savings.

3

Receive up to $30,000 through the First Home Owner Grant (if eligible).

4

Many states cut or remove stamp duty for first home buyers.

5

Every area has a maximum purchase price for the 5% option. We’ll check yours for you.

For Australian buyers, this means you can afford homes in suburbs that were previously out of reach. With unlimited scheme places, you won't be locked out, but competition will rise fast.

Getting pre-approved early ensures you don't miss out!

Every Day You Wait, You’re Bleeding Profits and Losing Deals

You’ve found the perfect site.

The numbers stack up.

But then—the funding stalls.

Banks drown you in red tape, private lenders slap on sky-high interest rates, and your project? Dead in the water.

Each delay sends costs spiralling—holding expenses, rising interest rates, and supplier prices creeping up by the day.

The longer you wait, the thinner your margins get, turning a once-profitable project into a financial headache.

Deadlines loom, budgets blow out, and suddenly you're scrambling to plug gaps just to keep things afloat.

While you’re battling delays, your competitors are closing deals, breaking ground, and cashing in.

The sites you scouted? Gone.

The profits you planned for? In someone else’s pocket.

Months of planning, negotiations, and site analysis? Wasted, all because the funding didn’t come through.

But it doesn’t have to be this way.

Hi, I’m Michael, Director at Balcombe Financial.

We help property developers secure the funding they need to acquire, build, and complete high-return developments—without the usual financial roadblocks.

Whether you’re working on a small subdivision, a large-scale apartment complex, or a commercial development, we tailor solutions that move your projects forward fast and with maximum flexibility.

With access to over 40+ bank, non-bank, and private lending solutions, we unlock flexible terms, maximise your loan amounts, and keep your projects moving from acquisition to completion.

“Michael found me a loan that others said wasn't possible”

- John Zambelis, Victoria

“Michael’s professional services were key in securing the finance on our commercial development in a tight timeframe”

- Casey Landman, Victoria

No more missed deadlines. No more compromises.

Just streamlined, stress-free financing that lets you scale your portfolio, maximise your profits, and build long-term wealth.

Ready to secure the capital you need—fast and stress-free?

Apply for your free 'Get Funded' Consultation with Victoria’s top property development finance experts.

We’ll never leave it up to algorithms or call centre staff to future growth of your projects.

In this complimentary 20-minute session, we’ll help you:

1

GET A FINANCING STRUCTURE BUILT FOR YOUR PROJECT:

Discover the exact funding solution for your development goals—no more ‘one-size fits all’ loans that don’t fit your needs.

2

SECURE FAST APPROVALS WITHOUT THE USUAL ROADBLOCKS: We’ll map out how to cut through lender red tape and get your project moving—before delays eat into your profits.

3

FUND YOUR PROJECT WITH LESS OF YOUR MONEY: We’ll show you how to secure financing with minimal personal capital and more lender flexibility than you thought possible.

4

WALK AWAY WITH A CLEAR, ACTIONABLE FUNDING STRATEGY: Get a clear, actionable financing strategy tailored to your development—no fluff, no wasted time, just the exact next steps to get funded fast.

Spots are limited, and projects are moving fast.

Don’t let another opportunity slip through your fingers— apply for your free ‘Get Funded’ Strategy Session today and secure the financing you need before it’s too late.

To your success,

Why Homeowners Across Australia Are Choosing Network Finance

Danielle Germech

"We have used Robbie for a few years now, and he and his team are amazing.

Nothing is ever too much trouble and I have harassed them over the years with frivolous questions and never once been made to feel a bother. Super efficient and I can’t recommend them enough. You want a broker team to go over and above then this is the team for you.

Michael Ruwaard

"We have used Network Finance previously, so we are return customers.

Very professional and friendly staff. Very happy to help and resolve any issues.

Would recommend this company to all.

Thank you."

James Brockhurst

"I've dealt with Matt Ingram on multiple occasions now, with matters from home loans to business loans.

I couldn't recommend him enough. Matt has always been able to answer any questions or queries I've had. Matt is very easy to deal with and replies in a very timely manner. I'm more than happy to recommend Matt to any of my friends and family."

Steven DC

"Matt and Kerry at Network Finance were fantastic. Their service is simply flawless.

This was about my seventh home loan, so I’ve dealt with many other brokers and banks, and this was by far the simplest, easiest experience I’ve ever had getting a loan.

This was a very time sensitive opportunity, and it got completed straight away."

Clinton Clarke

"I have just recently completed my finance dealings with Matt Ingram and his team at Network Finance, and I can honestly say it was an absolute pleasure to deal with Matt and his amazing team. My case was not easy, as there were a lot of outside variables at play, and Matt and his team were so supportive and helpful and got me the best products possible. I will be using Matt and his team 100%"

Macy Brockhurst

"Had the best experience with Matt and the team at Network Finance.

They helped my partner and I get a loan for our new home and explained everything in great detail throughout the whole process.

I will refer whoever I can to Matt. Cheers"

Completely free to explore.

No strings attached.

How Smart Developers

Get Funded

[Baseline Feature – Industry Standard]

[Baseline Feature – Industry Standard]

[Baseline Feature – Industry Standard]

[Hidden Cost or Downsides of Competitors]

[Customer Support/Service]

B

Comparison #1

Comparison #1

100% Free, No-Obligations

Got Questions?

We’ve Got the Answers

Who qualifies as a “first‑home buyer” under the new rules?

You must be an Australian citizen or permanent resident, aged 18+ and intend to live in the property as your principal place of residence. You must not have previously owned a residential property (check details per scheme).

What deposit do I need now?

Under the expanded First Home Guarantee (part of the Home Guarantee Scheme) from 1 Oct 2025, you can purchase with as little as a 5% deposit and avoid paying Lenders’ Mortgage Insurance (LMI) if you meet eligibility

Are there income limits or caps?

Under the new rules from 1 Oct 2025: there are no income caps for the First Home Guarantee.

What are the property price caps by location?

Yes — the scheme sets maximum purchase prices (caps) by state/region. From 1 Oct 2025 some examples:

- NSW (capital + regional centres): up to $1.5‑million.

- VIC (capital + regional centres): up to $950,000.

- QLD: up to $1,000,000.

Always check the full table for your specific postcode/region.

Can I apply for the Guarantee in combination with state grants or stamp duty concessions?

Yes, the federal Guarantee is separate from state‑based assistance. Many first‑home buyers can stack: the Guarantee (federal), state grants (e.g., new home grants), and stamp duty relief (if eligible). But the rules differ by state.

⚠️ Get Into Your First Home Sooner ⚠️

⚠️ Get Into Your First Home Sooner ⚠️

Apply for Your Free ‘First Home Strategy Session’ Today, and Discover Exactly Which Government Grants, Schemes & Guarantees You Qualify For.

In just one phone call, learn how you can begin your home journey without worrying if you've missed any grants, schemes or guarantees

Show your eligibility across all grants, concessions, and schemes.

Secure your pre-approval with one of 20+ participating lenders

Access up to $55,000 in combined savings and incentives.

Buy sooner, with clarity, confidence, and no hidden surprises.

You may be closer to owning your first home than you realise.

Our Service Will Help Decrease Burning Problem By Quantifiable Measure Or Penalty

We’re so confident in our ability to [Achieve Outcome] that we’re taking all the risk off your shoulders.

If we don’t [Specific Result Guarantee], you won’t pay a cent. No fine print, no hidden conditions – just a rock-solid guarantee to prove how committed we are to your success.

Because at [Your Business Name], we don’t just promise results. We guarantee them. If we don’t deliver, you don’t pay. It’s that simple.

100% Free, No-Obligations

Still Not Sure About Something?

Your 1st Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 2nd Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 3rd Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 4th Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 5th Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

100% Free, No-Obligations

Spots Are Filling Fast...

Claim Your Free Offer Name Today and Benefit

100% Free, No-Obligations

Information is general only and does not take into account your objectives, financial situation or needs. Eligibility criteria, property price caps, and lender requirements apply. The Home Guarantee Scheme is an Australian Government initiative administered by Housing Australia. Your full financial situation must be considered before any offer or acceptance of a loan product. Network Finance is authorised under Australian Credit Licence Number: 389653 | ABN 58071141430. This information does not constitute financial advice. Please seek advice from one of our accredited brokers before making decisions.

Privacy Policy & Terms and Conditions